tax on forex trading nz

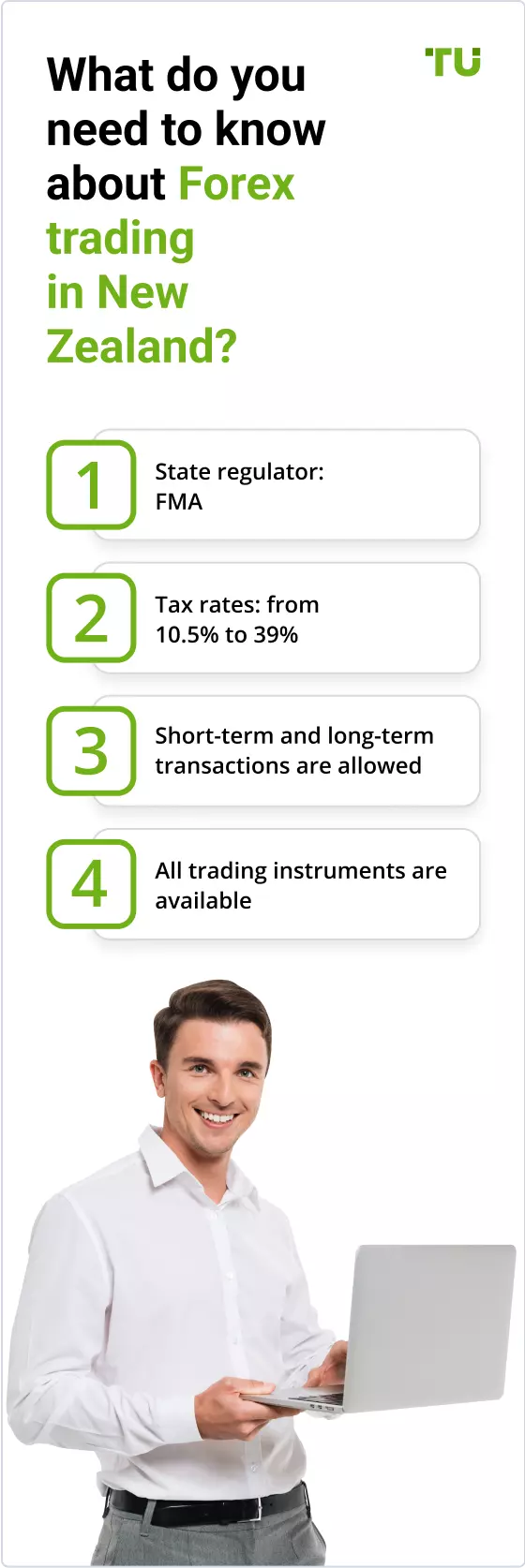

When trading futures or options investors are effectively taxed at the maximum long-term capital gains rate or 20 on 60 of the gains or losses and the maximum short-term capital gains rate. Tax rates of exchange trading in New Zealand Basic Taxes 0 14000 A rate of 005.

I cant find any guides in the IRD website that would assist me on how much should I pay.

. Although this tax is making me think twice. This is the amount that is payable as GST. CMC Markets - Excellent overall best platform technology.

Knowing which option to use be it spread betting or CFDs will mean being able to maximise the advantage of currency trading tax. I do operate under a limited company in this country currently trading stocks and considering forex. In New Zealand individuals or businesses offering these contracts must hold a derivatives issuer license from FMA.

Sharesight makes it easy to calculate gains or losses for share traders in New Zealand with our Traders Tax report. Up to 14000 105 up to 48000 175 up to 70000 30 and so on. Between Rs 1 Lakh and Rs 10 Lakh.

The frequency of your transactions. Forex trading is the buying and selling of foreign currencies. Unfortunately its a situation where the tax system could be accused of taxing gains in a.

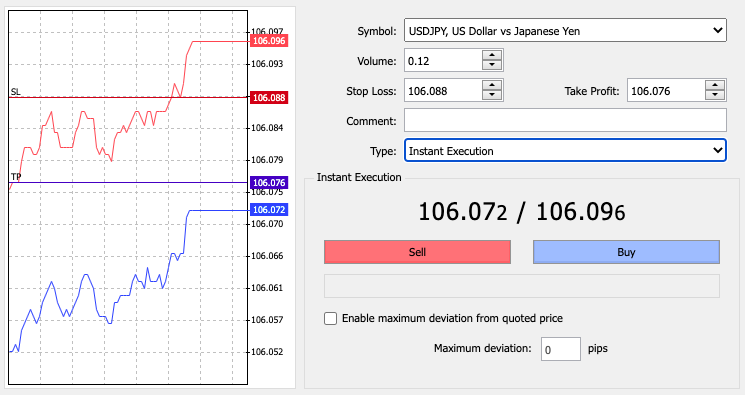

We regularly receive complaints and enquiries from consumers who have lost. Three years ago I attended a remarkable seminar. The company offers forex trading on MetaTrader 4 and MetaTrader 5 the two most popular trading platforms.

How much time and effort you put into buying selling or exchanging. As such they are subject to a 6040 tax consideration. Suggest keeping good records of trades in a separate bank account which will make tax time lots easier.

20-30 dollars gain in a week is very small. 0900 - 1200 and 1500 - 1600 WAT. Blackbull Markets was founded in 2014 and is incorporated licensed and operated in New Zealand.

To ensure you are fully compliant with New Zealand forex tax laws its best to speak to an accountant before trading. All NZ citizens and residents pay either Resident Withholding Tax RWT or tax at the Prescribed Investor Rate PIR on income from savings and investments in New Zealand. Forex traders can start with even 1.

Hi I am planning to trade in NZX ASX AND FOREX MARKET. Such investors must stick to the general taxation rules. Yes including capital gains tax.

In New Zealand individuals or businesses offering these contracts must hold a derivatives issuer license from FMA. Calculate gainslosses on NZ shares for tax purposes. New Zealand boasts a relatively strong economy free from the financial turmoil in the West.

The main way to tell if youre in the business of trading in cryptoassets is by looking at. Best time to trade in New Zealand. Our experts have compiled a list of the most essential.

Im trying to do online FX trading and really confuse with the tax. Currently New Zealand is considered a safe haven for forex brokers. Is Forex Trading Tax-Free In New Zealand.

BlackBull Markets - 35 Stars. But the question is is it taxable. Now you can move to choosing a platform for Forex Trading NZ.

The company keeps customers funds at ANZ bank which implies a high level of security. In the country taxation rates depend on the amount of income. Sharesights Traders Tax report calculates any taxable gains using one of four methods.

There will rarely be a day when something is tax free. Amount of traders in New Zealand 270 000 Updated April 2022. Who is the number 1 Forex Broker offering NZ denominated accounts.

A DIL license application is distinctly different from applying for FSP Registration for the Trading financial products or foreign exchange on behalf of other persons category. Plus500 - Trusted broker great for beginners. What Is The Minimum Deposit To Trade With An New Zealand FX Broker.

Forex trading is the buying and selling of foreign currencies. But I dont know if I should pay taxes on my gains. If your total income is.

In New Zealand forex traders must pay tax on the profits made from selling a currency if the currency was bought with the intention of resale. No all the traders are required to pay tax on their income from Forex trading. Certainly like any other gainful activity trading and investing are subject to taxes.

IG - Best overall broker most trusted. Unfortunately Blackbull Markets only offers a demo. If you are also classified as a self-employed trader you may have to pay income tax.

The taxable value of transactions falling within this bracket is Rs 1000 05 of the amount more than Rs 1 Lakh. A maximum of Rs 180 can be charged as GST for forex transactions of up to Rs 1 Lakh. The truth about forex trading.

Tell your provider that is your bank fund manager or financial. People trade in forex either to try to make a quick profit by betting on the changing value of a currency or to provide certainty about the cost of future foreign currency payments called hedgingThe risk of online foreign exchange trading is high. Tax in New Zealand for Forex Trading.

The tax rate is 33 of the trading income. Currency trading tax is advantageous in the current climate whether it is secondary income or your main source of income. Is my gain from foreign currency trading counted as capital gain.

Aspiring forex traders should consider tax implications before getting started on trading. Despite the fact that New Zealand does not have a Capital Gains Tax there are circumstances where gains made can be taxed as income. All the capital gained through trading currency pairs and other types of financial instruments is considered income which means that you will need to pay regular taxes on it.

Companies in Cyprus are tax free on stocks and bonds but the capital gain of 125 applies to forex profits. Working out if youre in the business of trading in cryptoassets. You need to choose the correct tax rate or you could face an unexpected bill at the end of the tax year.

Trading or dealing involves buying and selling cryptoassets to make a profit. Due to the nature of CFD products FMA. Is IRD chasing those individual traders.

Forex traders fortunes are tied to the swings of the US5 trillion-a-day foreign exchange market. First-in first-out FIFO First-in last-out FILO Minimise capital gain. New Zealand does not have any special taxation rules for Forex traders.

Forex Trading NZ - Best Forex Brokers Regulation Taxes In this. Here is our list of the top forex brokers in New Zealand. In addition the country is geographically near the Asia-Pacific region and its close proximity makes it easier for brokers to access the potentially huge market of forex traders there.

13 Point Summary on New Zealands Trading Regulations. It means that 60 of your gains or losses will be counted as long-term capital gains or losses while the remaining 40 will be counted as short-term gains or losses. Flick me a message Id easier.

Which Country Is Best For Forex Trading

How To Trade Forex Forex Trading Step By Step Benzinga

Forex Trading Nz Best Forex Brokers Regulation Taxes

Forex Trading Nz Best Forex Brokers Regulation Taxes

:max_bytes(150000):strip_icc()/dotdash_final_Why_Interest_Rates_Matter_for_Forex_Traders_Dec_2020-01-6d3057201aec47f1b1d86b60e90c2ce6.jpg)

Why Interest Rates Matter For Forex Traders

Goldman Sachs Says Rbnz Negative Rates Are Not A Done Deal But Here Is Why It Might Negativity Forex Trading News New Zealand

Forex Trading Strategy Online Forex Trading Forex Trading Forex Trading Strategies

Forex Trading Nz Best Forex Brokers Regulation Taxes

Forex Trading Nz Best Forex Brokers Regulation Taxes

Forex Trading Nz Best Forex Brokers Regulation Taxes

Chapter 11 Forex Trading Aud Nzd Spot Forex Example My Trading Skills

Forex Trading Academy Best Educational Provider Axiory Global

Forex Trading 2022 How To Trade Forex Beginners Guide

Stock Graph Analysis Stock Market Data Stock Market Forex Trading

Should You Enjoy Online Investments An Individual Will Really Like This Cool Site Trade Finance Investing Forex Trading

/dotdash_final_Forex_Market_Hours_Dec_2020-01-85c0a7fa11a347f8937001cc596a13cc.jpg)

:max_bytes(150000):strip_icc()/dotdash_final_Forex_Market_Hours_Dec_2020-01-85c0a7fa11a347f8937001cc596a13cc.jpg)